Climate Resilience Planning Could Have Averted Southwest’s Christmas Debacle

Southwest estimates the loss from their scheduling system meltdown to be around $825M. Those are just the direct costs of lost revenue from canceling more than 15,000 of its flights starting on Dec. 22. It doesn’t include the costs for fines, brand erosion and systems upgrades which will increase the loss to well over a billion dollars.

While, no matter what, some disruptions, delays and cancellations would have occurred due to the size and severity of the storm, the complete breakdown of the airline’s ability to serve its customers wasn’t necessary. So, why did it happen?

Southwest’s debacle reflects a widespread managerial culture that encourages increasing profits by cutting costs until there’s no margin for error. Corporate executives learned this strategy when they earned their MBAs. For example, a relentless focus on holding down expenses was at the root of worker anger that almost shut down America’s freight railways.

Corporate executive compensation is often based on stock price fluctuations reflecting quarterly earnings. So executives are incented to address any immediate problem with duct tape and baling wire, rather than spending a large amount of money to address the root problem. Software upgrades (the core cause of Southwest’s breakdown was antiquated software) are not only expensive, but they are difficult to pull off successfully – so executives are even more reticent to undertake them.

So they prefer to bet that whatever catastrophe may be in the making will blow up under someone else’s tour of duty. Such bets often pay off. That is how potential disruptions caused by our climate crisis are typically handled because they are perceived to be potential future events… “I’ll be retired by then.” But it’s no longer the reality. Climate caused disruptions are happening daily around the globe today… and they are growing in frequency and severity.

So the tactics worked… but no longer. As my Aussie mate, VUCA Strategist David Ross, wrote in his book, Confronting the Storm, “This is a ‘sliding doors’ moment available for leaders to confront and transcend the old ways. What got them to here, won’t get them to there.” What David is referring to are the rapid changes in society, technologies, and our physical environment that are injecting uncertainty into every business. Antiquated thinking that once increased profits now increases risks of catastrophic losses.

Margins for Error Must Widen Not Disappear

The absence of agreements that would have made it possible to rebook passengers on other airlines made it worse. This is a key point to make as it pertains to climate resilience. Climate disaster planning is not only dependent on technological upgrades, or the hardening of infrastructure. It includes a more collaborative approach to business where competitors share the risks and make pacts to assist each other in times of crisis.

The software issue was a key factor in why Southwest Airways couldn’t return to business as usual the way other airlines did. Software shortcomings had contributed to previous, smaller-scale meltdowns, and Southwest unions had repeatedly warned about it. Lyn Montgomery, president of Southwest’s flight attendants’ union, stated that when hiccups or weather events happen, the employees have to go through a burdensome manual process to get things sorted, because Southwest hadn’t sufficiently modernized its crew scheduling systems. Until it does, it will continue to experience systemic failures as severe weather events increase in frequency.

Regulators had the power to impose penalties for the previous meltdowns, but didn’t, making it possible for Southwest to continue its short-term thinking until disaster struck. There was nothing, pre-catastrophe, to force Southwest to change. Regulators might have been persuaded that they were helping airlines by not imposing stricter regulations, but instead, they contributed to the meltdown. Lax regulations enabled this $1 billion+ loss.

It’s like designing a building. For example, if an architect includes features that strengthen the building’s ability to resist wildfire damage, the developer who is bank rolling the construction will nix them if there are no building codes in place requiring them. It is cheaper and quicker to skip the safety measures. The building might look and feel the same to its occupants… as long as there are no local wildfires. But if there are, the developer has no responsibility and the building’s tenants will pay the price.

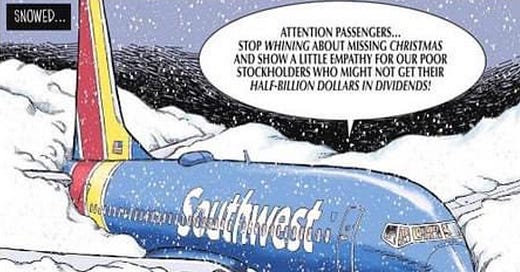

While Southwest’s executive team can be faulted for decisions to invest profits (and Federal COVID bailout money) in stock buy backs and dividend payments to shareholders, instead of investing in upgrading systems, hiring personnel to replace those let go during the pandemic, and having crisis resilience scenarios in place for such a contingency… those were logical business decisions within an economic system that rewards that behavior. Those were easy and lazy actions to take to inflate share prices… the only factor that matters in a system that measures success with an exclusive focus on growth.

What’s required is a mind shift… a cultural change. Personnel further down in the organization have been asking for the upgrades for years. Management was well aware. But since they were not required by policy and regulations to make the called for changes… they didn’t. (In addition to the recommendations I make below, Secretary of Transportation Pete Buttigieg should be instituting the regulations his predecessors in the Trump and Obama administrations failed to establish.)

In the years leading up to the pandemic, the company spent $8.5 billion of its excess cash on purchasing its own stock – a common practice among airlines which helps increase the value of the stock. Then, when the pandemic hit, like other airlines, Southwest received billions from the government in grants and low-interest loans.

David Horsey, editorial cartoonist, The Seattle Times

What if?

There’s another way that could have reduced the disruption.

What if the company had embarked on a climate resilience initiative?

What’s that? It is an effort to predict the climate impacts a business is vulnerable to (the airline industry is unusually vulnerable to the severe weather events that are a hallmark of our climate crisis), and to embed an awareness of those impacts throughout the business.

Why?

Because when every employee (and other stakeholders like the Board and stockholders) understand the potential climate risks the business faces, they understand the need for investments in resilience and adaptation. And they are vigilant in looking for solutions.

What if climate literacy was injected into the operating system of Southwest? What if climate resilience had been cultivated as a core purpose of the company culture? What if every stakeholder in the company understood the danger to the company (and its stakeholders – including customers) from our climate crisis?

What would that look like?

Instead of the bailout money and profits being funneled to stock buy backs, dividend payments and executive bonuses, it would have been spent on research, strategic foresight, climate risk management and scenario planning to strategize (and budget) for potential climate impacts to operations. There are many including:

extreme heat melting runways and making the air too thin to support the aerodynamics of flight

thick smoke from massive wild fires reducing cockpit visibility

runway lengths shortened by sea level rise

enormous snow storms caused by a meandering polar vortex

regulations on the horizon requiring reduction of emissions

melting permafrost resulting in the buckling and instability of airport runways

severe precipitation events flooding runways and other infrastructure

an unpredictable jet stream causing flight delays, reroutings and increases in fuel use/cost

drought-related dust storms that damage jet engines

and more.

Yes, and…

Then a determination regarding which were the most probable impacts to be experienced, and which would have the most deleterious effects. Then a deep dive into those impacts to determine how best to manage those risks.

That exercise would have provided Southwest with the catalyst to upgrade systems, hire relevant personnel, and institute crisis resilience plans. The Christmas storm would still have disrupted the airline’s operations, but to a much lesser extent and the company would be in a much stronger position today and going forward.

Climate Resilience is Disaster Preparedness

We’d all be better off if corporations were less focused on their short-term bottom lines and more willing to invest in resilience. Southwest Airways would be $1 billion+ better off. And public policy should do what it can to promote such investment. But well-managed corporations won’t wait for government mandates.

Organizations need to evolve and reprioritize. Climate impacts will continue to grow in size, frequency and severity. Strategized, and budgeted for, climate resilience can not only reduce the damages, but can reinvent an organization’s structure, business model, and company culture… making it fit for the future we will all experience.

For Southwest and many other corporations (and smaller businesses too) a climate resilience transition plan will constitute a business survival strategy.

Bob Leonard is the Managing Consultant at Climate Foresight Advisory, and the co author (with futurist David Houle) of “Moving to a Finite Earth Economy”.